5 Major Impacts of RBI's Surprise Repo Rate Cut on Your Money & Future

Introduction

Have you ever wondered why your loan EMIs fluctuate or why your fixed deposit interest rates change? These shifts often trace back to critical decisions made by the Reserve Bank of India (RBI). Recently, the RBI's Monetary Policy Committee (MPC) delivered a significant and largely unexpected announcement – a substantial RBI Repo Rate Cut Impact of 50 basis points (0.50%). This isn't just financial jargon; it’s a move that will directly influence your wallet, from your monthly loan payments to the returns on your savings. This comprehensive guide will demystify these changes, explain their profound effects, and provide you with actionable steps to navigate the evolving financial landscape and make your money work harder for you.

What Exactly Is the Repo Rate & Cash Reserve Ratio (CRR)?

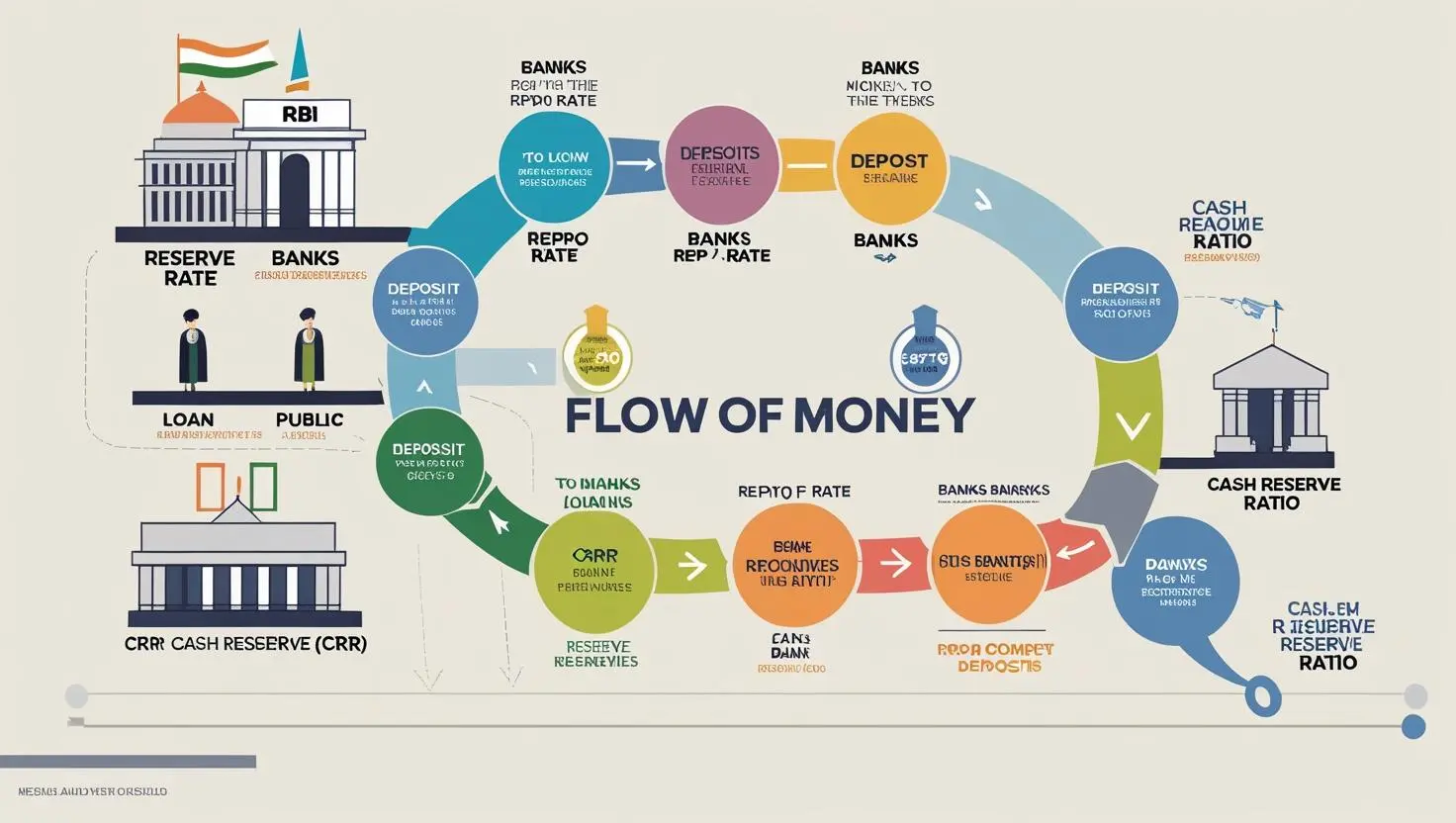

Understanding the RBI's recent decisions begins with grasping two fundamental concepts: the Repo Rate and the Cash Reserve Ratio (CRR).

The Repo Rate: Think of the Repo Rate as the interest rate at which commercial banks (like SBI, HDFC, ICICI, etc.) borrow money from the Reserve Bank of India (RBI) for their short-term needs. The term "Repo" stands for "Repurchase Option" or "Repurchase Rate." When the RBI lowers the Repo Rate, it means banks can borrow money cheaper. This reduced borrowing cost for banks is then ideally passed on to you, the consumer, in the form of lower interest rates on loans. Conversely, a higher repo rate makes borrowing more expensive for banks, leading to higher loan rates for you.

Cash Reserve Ratio (CRR): The CRR is the percentage of a bank's total deposits that it must keep as reserves with the RBI. This money cannot be lent out by the banks. It acts as a safety net and a tool for the RBI to control liquidity in the economy. For instance, if a bank has ₹1 Crore in deposits and the CRR is 4%, it must keep ₹4 Lakh aside. The remaining ₹96 Lakh is available for lending. When the RBI lowers the CRR, banks suddenly have more money available to lend out, boosting market liquidity.

Why Should You Care About These RBI Decisions?

These seemingly technical adjustments by the RBI have a direct and tangible impact on your everyday financial life. If you have a home loan, a personal loan, or fixed deposits, these changes could mean significant savings or reduced returns.

Consider Ravi, a young professional who took out a home loan with a floating interest rate. When the RBI cuts the Repo Rate, banks' borrowing costs decrease, and they often lower their lending rates. For Ravi, this could mean his monthly EMI (Equated Monthly Installment) could go down, or the tenure of his loan could shorten, saving him potentially lakhs of rupees over the loan period.

Similarly, if you rely on fixed deposits for your savings, a Repo Rate cut typically signals a decline in FD interest rates. Why? Because banks can now borrow cheaper from the RBI, they have less incentive to offer high rates to attract deposits from you. This is why being proactive after such announcements is crucial.

The script also highlights a massive ₹2.5 lakh crore liquidity boost injected into the market. This means more money is available for lending and spending, which can stimulate economic activity – from increased consumption (people buying cars, homes, going on vacations) to greater investments, all of which contribute to GDP growth. This surge in liquidity can fuel market sentiment and drive up asset prices, particularly in the stock market.

Key Decisions from RBI's MPC Meeting

The Monetary Policy Committee (MPC), a six-member body led by the Governor, meets every two months to assess the economic situation and make crucial decisions regarding interest rates. On June 6th, the MPC made two major announcements that will profoundly impact the Indian economy and your personal finances:

The Repo Rate Cut: A Surprise Move

The biggest headline was the reduction of the Repo Rate from 6% to 5.5%, a significant cut of 50 basis points (0.50%). This decision was supported by five of the six MPC members, indicating a strong consensus on the need to inject liquidity and stimulate growth.

- Impact: By making borrowing cheaper for commercial banks, the RBI encourages them to lend more freely and at lower rates to businesses and individuals. This can lead to increased investment, consumption, and overall economic expansion.

.

.

Cash Reserve Ratio (CRR) Reduction: Freeing Up Bank Capital

In addition to the Repo Rate cut, the RBI also announced a reduction in the Cash Reserve Ratio (CRR) from 4% to 3%. This might seem like a small percentage change, but its impact on the banking system's liquidity is immense.

- Impact: This 1% reduction means banks now need to hold less of their deposits as reserves with the RBI. Consequently, a substantial amount of additional capital (as highlighted in the script, around ₹2.5 lakh crore across the banking system) is freed up, directly increasing the funds available for banks to lend to businesses and individuals. This double-whammy of cheaper borrowing (via Repo Rate) and more available funds (via CRR) creates a potent stimulus.

The "Impossible Trinity" & RBI's Balancing Act

The RBI's decisions are complex, balancing what economists call the "Impossible Trinity" – the challenge of simultaneously managing Interest Rates, Inflation, and GDP Growth. It’s like playing a game of "whack-a-mole" with the economy.

- If the RBI lowers interest rates (as it just did), it aims to boost GDP growth (by encouraging borrowing and spending). However, increased spending can lead to higher inflation (things becoming more expensive).

- Conversely, raising interest rates can curb inflation but might slow down economic growth.

The script notes that the RBI revised its inflation target downward to 3.7%, signaling confidence that inflation is under control. This lower inflation outlook gave Governor Sanjay Malhotra (as per the script's narrative) the room to cut rates without immediate fear of runaway price increases, prioritizing growth. This strategic move aims to spur economic activity while keeping a watchful eye on price stability.

How These Changes Affect You & Your Money: Actionable Steps

Now that you understand the "what" and "why," let's talk about the "how." These RBI decisions present both opportunities and challenges for your personal finances. Here's what you should do:

1. Re-negotiate Your Existing Loans (Home, Personal, Vehicle)

If you have a floating-rate loan, this is your golden opportunity to potentially reduce your financial burden.

- Immediate Action: Contact your bank or NBFC (Non-Banking Financial Company) immediately.

- Your Goal: Request a re-negotiation of your interest rate. Since the banks' borrowing costs have reduced, they have the margin to offer you a lower rate.

- Reduce EMI or Duration?

- If your current EMIs are a financial strain, opt to reduce your EMI amount. This will free up cash flow for other needs.

- If you're comfortable with your current EMI, consider reducing your loan duration. This will save you significantly more on interest over the long term. For example, shortening a 20-year loan by even a couple of years can save you lakhs.

- Pro-Tip: Don't hesitate to negotiate. Your bank wants to retain you as a customer.

2. Lock-in High-Interest Fixed Deposits (FDs) NOW

The lower Repo Rate will inevitably lead to lower fixed deposit interest rates from banks in the near future. Banks will have less incentive to offer high rates when they can borrow cheaply from the RBI.

- Immediate Action: If you have idle cash reserves or maturing FDs, consider locking them in at current, higher rates.

- Strategy: Look for banks offering competitive FD rates before they revise them downwards.

- Tool Suggestion: The script mentioned the Stable Money app (an RBI-approved platform with over 12 lakh users). It allows you to compare FD rates across various banks and even open FDs without needing an account at that specific bank. Some scheduled banks offer rates up to 9-9.2% on Stable Money, and deposits up to ₹5 Lakh are insured by DICGC (a subsidiary of RBI). This is a strategic move to secure higher returns on your savings before the market adjusts.

3. Understand Market Liquidity & Investment Opportunities

The ₹2.5 lakh crore liquidity boost from the CRR cut means more money flowing into the economy.

- Impact on Consumption: Cheaper loans will encourage people to buy homes, cars, and consumer durables, and spend on vacations. This boosts sectors like housing, automotive, and aviation.

- Impact on Stock Market: Increased liquidity often translates to higher investor confidence and buying power. The script highlights how the Bank Nifty surged by 800 points (1.47%) on the day of the announcement, reflecting immediate positive sentiment towards banks (due to improved profit margins from cheaper borrowing). This positive sentiment can extend to other sectors as consumption and investment pick up.

- Your Role: While not a direct action, understanding this dynamic helps you make informed investment decisions. This is not financial advice to blindly invest, but rather to recognize the broader economic tailwinds.

Common Mistakes to Avoid Regarding RBI's Rate Changes

Navigating these financial shifts requires caution. Here are a few common pitfalls to avoid:

- Delaying Loan Re-negotiation: Don't wait! Banks are quick to lower FD rates but often slow to pass on benefits to existing loan customers. Procrastinating means leaving money on the table.

- Ignoring Fixed Deposit Opportunities: Assuming all FDs will instantly offer low rates can lead you to miss out on current attractive rates before they drop. Not locking in means lower returns on your savings.

- Panicking in the Stock Market: While market sentiment is positive, don't get swept up in "herd mentality" or make investment decisions based purely on short-term news. Impulsive buying or selling based on tips, without research, can lead to losses.

- Not Understanding the "Why": Merely knowing rates have changed isn't enough. Not understanding why they changed and their broader implications (like the Impossible Trinity) means you're less equipped to make strategic financial decisions in the future. Staying uninformed limits your financial potential.

Final Thoughts

The recent RBI Repo Rate cut and CRR reduction are more than just economic news; they are a significant development that directly impacts your personal finances. From making your loans more affordable to influencing your savings returns, these changes demand your attention and proactive response. By re-negotiating your loans, locking in current high FD rates, and understanding the broader economic implications, you can effectively leverage these policy changes to your advantage.

What's your biggest takeaway from this detailed explanation? Are you planning to contact your bank or lock in an FD soon? Share your immediate plans or any lingering questions in the comments below! Your financial journey is unique, and understanding these shifts is a powerful step towards greater financial control.

Blog by Santu Das

Personal Finance Educator | Simplifying Money for Everyday Lives