5 AI-Powered Tools That Streamline Your Personal Budgeting in 2025

Ever feel like your money slips through your fingers faster than you can say “chai break”? You’re not alone. Managing personal finances can feel like wrestling a monsoon flood, especially when unexpected expenses pop up. But here’s the good news: AI-powered budgeting tools are transforming how we handle money in 2025. These smart apps act like your personal financial coach, automating tedious tasks and giving you clarity to achieve your goals—whether it’s saving for a dream vacation or paying off that pesky credit card.

In this post, you’ll discover five cutting-edge AI tools for personal budgeting that make tracking expenses, setting goals, and saving money effortless. Designed for Indian millennials and Gen Z navigating rising costs, these tools are your ticket to financial peace. Ready to take control? Let’s dive in!

What Are AI-Powered Budgeting Tools?

AI-powered budgeting tools are apps or software that use artificial intelligence to simplify money management. Imagine them as a virtual money guru who tracks your spending, categorizes transactions, and nudges you toward smarter financial choices—all without the judgmental stare of a traditional banker. These tools analyze your financial data, predict future expenses, and offer personalized tips, making budgeting as easy as ordering food online.

Take Priya, a 28-year-old marketing professional from Delhi. She used to dread budgeting, scribbling expenses in a notebook that always got lost. Then she tried an AI budgeting app that synced with her bank account, automatically sorted her spends, and alerted her when she overspent on dining out. Within months, she saved ₹15,000 for a new laptop. That’s the magic of AI—it turns chaos into clarity.

Why Should You Care About AI Budgeting Tools?

Why bother with AI budgeting tools when you’ve survived with spreadsheets (or sheer luck) so far? Because they save you time, reduce stress, and help you build wealth. In 2025, with inflation nibbling at your savings and lifestyle costs soaring, these tools are a lifeline. They don’t just track your money—they empower you to make it work harder.

Consider Vikram, a 32-year-old freelancer from Bengaluru. He struggled to manage irregular income until he used an AI tool that predicted his cash flow and suggested savings tweaks. In a year, he built an emergency fund of ₹50,000, giving him peace of mind during lean months. AI tools offer real-time insights, automate savings, and align with your goals—whether it’s buying a home or funding your side hustle. Plus, they’re perfect for tech-savvy Indians who want convenience without complexity.

5 AI-Powered Tools for Personal Budgeting

Here are five AI-powered budgeting tools revolutionizing personal finance in 2025. Each is packed with features to suit different needs, from solo savers to couples.

1. Cleo: Your Sassy Financial Sidekick

Cleo is an AI chatbot that makes budgeting feel like chatting with a witty friend. It syncs with your bank, tracks spending, and offers personalized advice with a dash of humor. Popular among Gen Z, Cleo’s AI categorizes expenses, sets budgets, and even “roasts” you for overspending on coffee.

- Why It’s Great: Fun interface, real-time alerts, and overdraft protection up to ₹8,000 (approx. $100).

- Example: Ask Cleo, “Can I afford this ₹2,000 jacket?” and it’ll check your budget instantly.

2. YNAB (You Need A Budget): Zero-Based Budgeting Made Smart

YNAB uses AI to power its zero-based budgeting philosophy—every rupee gets a job. It connects to your accounts, categorizes transactions, and provides insights to improve habits. Its AI predicts recurring expenses and suggests budget tweaks.

- Why It’s Great: Ideal for disciplined savers who want detailed control.

- Example: YNAB helped Anjali, a Pune teacher, allocate ₹5,000 monthly to her child’s education fund.

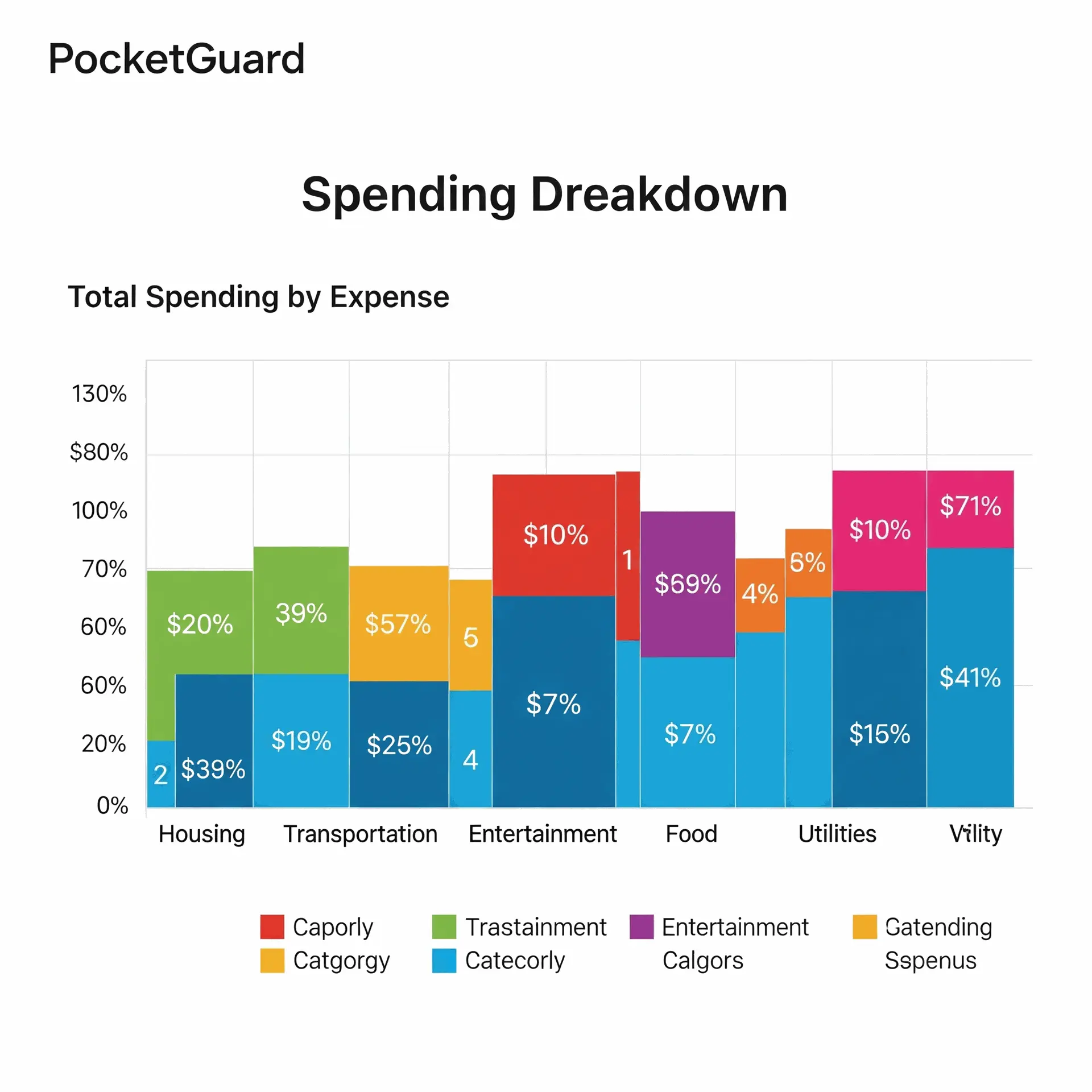

3. PocketGuard: Know Your “Safe-to-Spend” Amount

PocketGuard’s AI tracks bills, goals, and necessities, then shows how much you can spend guilt-free. It’s perfect for those who want simplicity without sacrificing insight. Its algorithms flag overspending and suggest savings opportunities.

- Why It’s Great: Visual dashboard and easy setup for beginners.

4. Zeta: Budgeting for Couples and Families

Zeta is designed for shared finances, using AI to split expenses, track joint goals, and generate reports. It’s a lifesaver for couples or families managing household budgets, with features like automated bill splitting.

- Why It’s Great: Simplifies joint budgeting with transparency.

- Example: Mumbai couple Neha and Rohan used Zeta to save ₹20,000 for a vacation by tracking shared expenses.

5. Empower: Budgeting Meets Investing

Empower combines AI budgeting with investment tracking for a holistic view. It analyzes spending patterns, suggests savings, and offers retirement planning tools. Its AI provides monthly reports to keep you on track.

- Why It’s Great: Great for those balancing budgeting and long-term wealth-building.

Which of these tools matches your budgeting style—simple and fun like Cleo or detailed like YNAB? Share in the comments!

How to Use AI Budgeting Tools: 5 Actionable Steps

Ready to streamline your finances? Follow these steps to make the most of AI budgeting tools in 2025.

- Choose the Right Tool: Pick one from the list based on your needs—solo (Cleo, PocketGuard), detailed (YNAB), couples (Zeta), or wealth-focused (Empower).

- Link Your Accounts: Securely connect your bank and credit cards for automatic transaction tracking. Most tools use bank-level encryption, so your data’s safe.

- Set Clear Goals: Define goals like saving ₹10,000 for an emergency fund or paying off a ₹50,000 loan. AI tools tailor budgets to these targets.

- Review AI Insights: Check weekly for AI-generated tips, like cutting ₹2,000 on dining out or reallocating funds to savings.

- Adjust and Automate: Use AI predictions to tweak budgets monthly and automate savings transfers to stay on track.

Common Mistakes to Avoid with AI Budgeting Tools

Even the best tools won’t work if you fall into these traps. Here’s what to watch out for.

- Ignoring Notifications: Skipping AI alerts about overspending is like ignoring a smoke alarm. Solution: Set aside 5 minutes weekly to review alerts.

- Not Updating Goals: Life changes, and so should your budget. Solution: Revisit goals quarterly to reflect new priorities, like a job switch or rent hike.

- Overcomplicating Things: Trying to track every paisa can overwhelm you. Solution: Start with broad categories like food, rent, and savings.

RBI's Financial Education Website

Final Thoughts

AI-powered budgeting tools are like GPS for your finances—guiding you to your goals with less stress. In 2025, tools like Cleo, YNAB, PocketGuard, Zeta, and Empower make it easier than ever to save, spend wisely, and build a secure future. Whether you’re a freelancer juggling irregular income or a couple planning a big purchase, there’s an AI tool for you.

Take the first step today: download one of these apps (Cleo’s free version is a great start) and spend 10 minutes setting it up. What’s one financial goal you want to crush this year? Drop it in the comments—I’d love to cheer you on!

Blog by Santu Das

Personal Finance Educator | Simplifying Money for Everyday Lives