Credit Score Myths Debunked: What Indian and US Lenders Really Check

Ever felt like your credit score is a mysterious number holding your financial dreams hostage? Whether you’re applying for a home loan in Mumbai or a car loan in Chicago, myths about credit scores can lead to costly mistakes. From believing a high income guarantees a great score to thinking checking your report hurts it, misinformation is rampant. For Indian and US borrowers, understanding what lenders actually check can unlock better loan terms and financial freedom.

In this guide, we’ll debunk 10 common credit score myths, reveal what Indian and US lenders focus on, and share actionable tips to boost your score. Tailored for salaried professionals, freelancers, and small business owners in both countries, this post simplifies the credit game. Ready to separate fact from fiction? Let’s dive in!

What Are Credit Scores and Why Do They Matter?

A credit score is a three-digit number (300–850 in the US, 300–900 in India) that summarizes your creditworthiness based on your financial history. In the US, FICO and VantageScore are common, while in India, CIBIL, Experian, and Equifax dominate. Lenders use it to assess your ability to repay loans or credit cards, impacting approvals, interest rates, and terms.

Take Priya, a 29-year-old IT professional in Bengaluru. She assumed her high salary ensured loan approval, but a missed credit card payment tanked her CIBIL score, delaying her home loan. Similarly, Jake, a 34-year-old teacher in Seattle, thought checking his score hurt it, so he avoided monitoring it, missing errors that raised his mortgage rates. Knowing what lenders check helps you avoid such pitfalls and secure better financial deals.

Why Should You Care About Credit Score Myths?

Misconceptions about credit scores can sabotage your financial plans. In India, where 67% of urban millennials use credit (2024 data), myths can lead to rejected loans or high interest rates. In the US, with 80% of adults having credit cards, misunderstandings can mean paying thousands extra in interest. Debunking these myths empowers you to improve your score, save money, and achieve goals like buying a home or starting a business.

Consider Arjun, a Delhi freelancer who believed closing old cards would boost his score. Instead, it hurt his credit history, delaying a business loan. In the US, Sarah avoided applying for credit, thinking it always dings her score, missing out on better rates. Clearing up these myths helps you make smarter financial moves in both countries.

10 Common Credit Score Myths Debunked

Here are 10 widespread myths about credit scores, what Indian and US lenders actually check, and the truth behind each, backed by industry insights.

1. Myth: Checking Your Credit Score Hurts It

Truth: Checking your own score is a soft inquiry and doesn’t affect your score in the US or India. Lenders only see hard inquiries (e.g., loan applications), which may lower your score by 5–10 points temporarily.

- What Lenders Check: Hard inquiries, especially multiple ones in a short period, signal risk. In India, CIBIL tracks inquiries for 12 months; in the US, FICO considers them for 24 months.

- Example: Priya checks her CIBIL score monthly via the CIBIL app—safe. But applying for three credit cards in a week triggers hard inquiries, worrying lenders.

- Source:,,

2. Myth: A High Income Guarantees a Good Credit Score

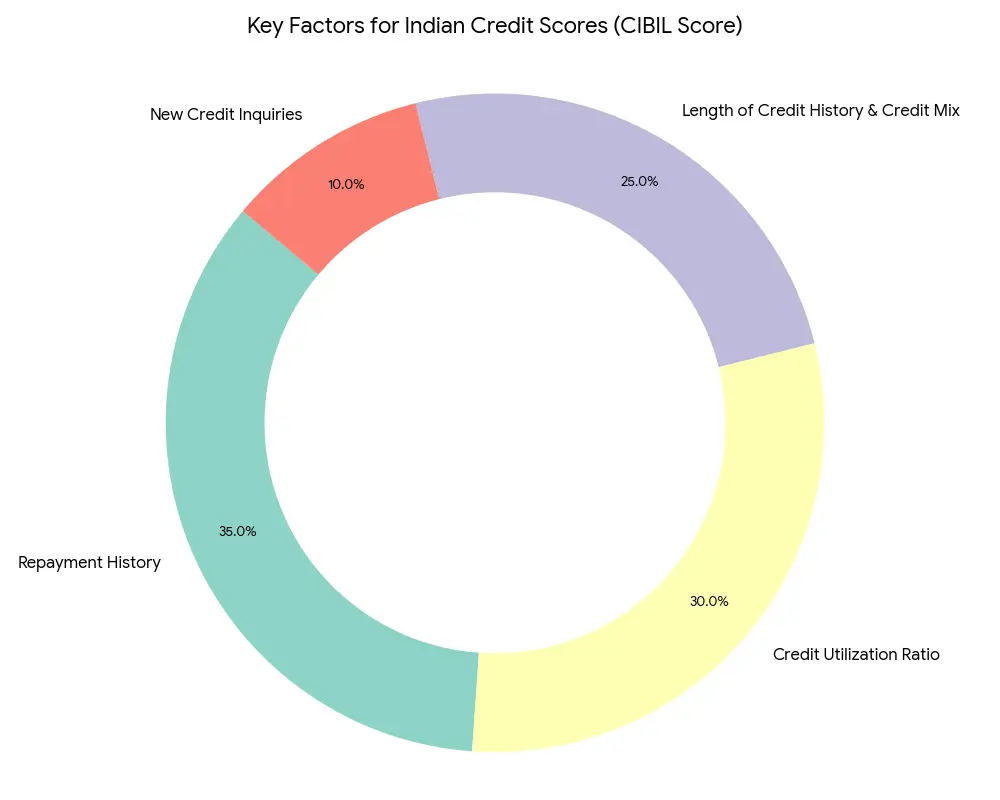

Truth: Income doesn’t directly affect your score in either country. Scores are based on payment history (35%), credit utilization (30%), credit history length (15%), new credit (10%), and credit mix (10%).

- What Lenders Check: Lenders like HDFC (India) or Wells Fargo (US) verify income separately for loan affordability, not your score. Poor payment habits can tank even high earners’ scores.

- Example: Jake earns $80,000 but missed student loan payments, dropping his FICO to 600.

- Source:,,

3. Myth: Closing Old Credit Cards Boosts Your Score

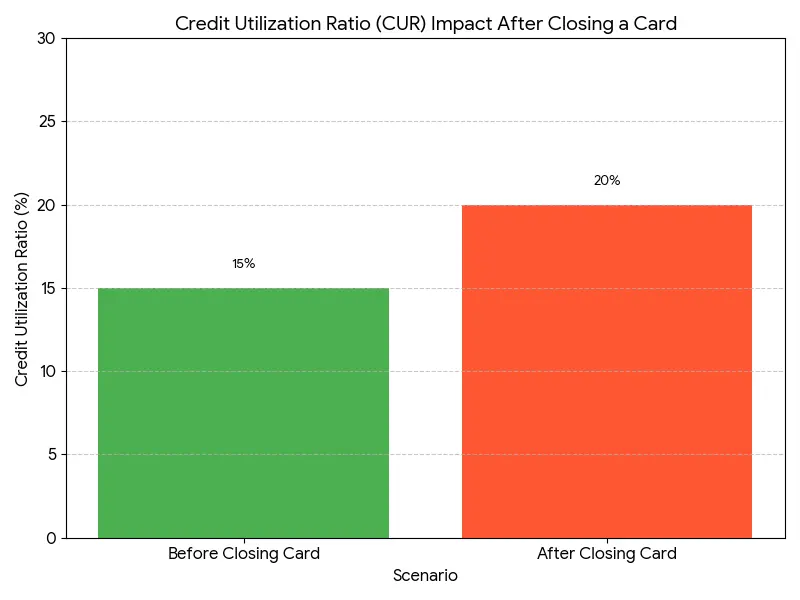

Truth: Closing old cards can hurt your score by shortening credit history and increasing credit utilization ratio (CUR). Keeping unused cards active with small transactions helps.

- What Lenders Check: In India, CIBIL values long credit history; in the US, FICO penalizes high CUR (above 30%). Closing a card with a ₹50,000 or $5,000 limit raises CUR if balances stay the same.

- Example: Arjun closed a 10-year-old card, raising his CUR from 25% to 40%, lowering his CIBIL score.

- Source:,,

4. Myth: You Have One Universal Credit Score

Truth: You have multiple scores. In the US, FICO and VantageScore differ by bureau (Equifax, Experian, TransUnion). In India, CIBIL, Experian, and CRIF High Mark use different models. Lenders may also calculate custom scores.

- What Lenders Check: Indian banks like SBI use CIBIL primarily (600+ is decent), while US lenders like Chase may use FICO (670+ is good). Each pulls specific bureau data.

- Example: Sarah’s FICO score is 720, but her VantageScore is 700, affecting loan offers.

- Source:,,

5. Myth: No Credit History Means a Perfect Score

Truth: No credit history means no score or a low one, as bureaus lack data to assess you. Lenders prefer a solid repayment history over no history.

- What Lenders Check: In India, “thin file” borrowers face higher rates; in the US, they may need secured cards to build credit.

- Example: Rohan, a first-time borrower, was denied a loan due to no CIBIL score but got a secured card to start.

- Source:,

6. Myth: Carrying a Credit Card Balance Improves Your Score

Truth: Carrying a balance hurts your score by increasing CUR and accruing interest. Paying off cards monthly is best.

- What Lenders Check: Both US (FICO) and Indian (CIBIL) models favor low CUR (under 30%). High balances signal risk.

- Example: Jake carried a $2,000 balance on a $5,000 limit, raising his CUR to 40%, dinging his score.

- Source:,

7. Myth: Debit Card Use Builds Your Credit Score

Truth: Debit card transactions don’t affect your score, as they don’t involve credit. Only credit cards and loans build credit history.

- What Lenders Check: Lenders in both countries look at credit-based accounts, not bank account activity.

- Example: Priya’s heavy debit card use didn’t help her CIBIL score until she got a credit card.

- Source:,

8. Myth: A Low Score Means No Loan Approvals

Truth: A low score doesn’t guarantee rejection. Lenders consider income, job stability, and debt-to-income ratio. Low scores may mean higher rates or smaller loans.

- What Lenders Check: In India, SBI may approve loans at 650 CIBIL with high income; in the US, FHA loans accept scores as low as 580.

- Example: Arjun got a car loan at 8% interest despite a 620 CIBIL, thanks to his stable job.

- Source:,

9. Myth: There’s a Credit Blacklist

Truth: No blacklist exists in the US or India. Lenders assess your credit report, application, and history individually. Past issues like defaults may lead to higher rates, not outright bans.

- What Lenders Check: Indian lenders check CIBIL for defaults (up to 7 years); US lenders review bankruptcies (up to 10 years).

- Example: Sarah was approved for a loan despite a past default, but at a higher rate.

- Source:,

10. Myth: Paying Off Debt Erases It from Your Record

Truth: Paid-off debts stay on your report—7 years in the US, 3–10 years in India—showing responsible repayment, which helps your score. Missed payments linger too.

- What Lenders Check: Both US and Indian lenders value consistent repayment history, even if old.

- Example: Rohan’s paid-off loan boosted his CIBIL score, despite a few late payments years ago.

- Source:,

Which credit score myth surprised you most? Share your thoughts in the comments!

What Indian and US Lenders Really Check

Lenders in both countries focus on these key factors beyond your credit score:

- Payment History: Timely payments on loans and cards are critical (35% of FICO/CIBIL).

- Credit Utilization Ratio (CUR): Keep it below 30% to show responsible credit use.

- Debt-to-Income Ratio (DTI): In the US, DTI below 43% is ideal; in India, banks like ICICI prefer below 40%.

- Income and Job Stability: Verified via pay stubs (US) or ITRs (India) to ensure repayment capacity.

- Credit History Length: Longer histories (e.g., 5+ years) boost credibility.

- Recent Inquiries: Multiple hard inquiries in 14–45 days (US) or 12 months (India) raise red flags.

How to Boost Your Credit Score: 5 Actionable Steps

Ready to improve your score for better loan terms? Follow these steps tailored for US and Indian borrowers.

- Check Your Report Regularly: Get free reports from AnnualCreditReport.com (US) or CIBIL (India, one free per year). Dispute errors promptly.

- Pay Bills on Time: Set autopay for credit cards and loans to avoid missed payments.

- Lower Credit Utilization: Pay down balances to keep CUR below 30%. Example: Pay ₹15,000 on a ₹50,000 limit card.

- Keep Old Accounts Open: Maintain active cards with small, timely transactions to preserve credit history.

- Limit New Applications: Apply for credit sparingly; shop for loans within 14–45 days to minimize hard inquiries.

Common Mistakes to Avoid with Credit Scores

Don’t let these slip-ups hurt your score:

- Ignoring Errors: Uncorrected report errors (e.g., wrong payments) can lower your score. Solution: Dispute inaccuracies with CIBIL or Equifax.

- Maxing Out Cards: High CUR signals risk. Solution: Pay balances before the statement date.

- Applying Everywhere: Multiple hard inquiries scare lenders. Solution: Research lenders and apply selectively.

Final Thoughts + Call to Action

Credit score myths can cost you time, money, and opportunities. By understanding what Indian and US lenders really check—payment history, CUR, and more—you can take control of your financial future. Whether you’re aiming for a home loan in India or a mortgage in the US, a strong score opens doors to lower rates and better terms.

Take one step today: check your credit report for free (CIBIL or AnnualCreditReport.com) and review it for errors. What’s one financial goal you’re chasing with a better credit score? Share in the comments—I’d love to cheer you on!

Blog by Santu Das

Personal Finance Educator | Simplifying Money for Everyday Lives