Understanding ETFs for Wealth Building: A Beginner's Guide for US & Indian Investors

Ever wondered how to grow your wealth without spending hours analyzing stocks? Whether you’re sipping coffee in New York or chai in Mumbai, the struggle to make your money work harder is real. Enter Exchange-Traded Funds (ETFs)—a simple, powerful tool to build wealth without the stress of picking individual stocks. ETFs are like a diversified basket of investments, offering growth potential with less risk. For beginners in the US and India, they’re a game-changer.

In this guide, you’ll learn what ETFs are, why they’re perfect for wealth building, and how to start investing in them. Tailored for US and Indian investors new to the market, this post breaks down ETFs with relatable examples and practical steps. Ready to take control of your financial future? Let’s dive into the world of ETFs!

What Are ETFs?

ETFs, or Exchange-Traded Funds, are investment funds traded on stock exchanges, much like stocks. They pool money from investors to buy a diversified mix of assets—stocks, bonds, or even gold—tracking an index like the S&P 500 or Nifty 50. Think of an ETF as a thali: a single plate with a variety of dishes, giving you a taste of everything without cooking each item yourself.

Take Priya, a 27-year-old software engineer in Bengaluru. She wanted to invest but was overwhelmed by stock market jargon. She chose a Nifty 50 ETF, which gave her exposure to India’s top 50 companies in one go. Similarly, Jake, a 30-year-old teacher in Chicago, invested in an S&P 500 ETF to own a slice of America’s biggest firms. ETFs make investing simple, affordable, and diversified for beginners.

Why Should You Care About ETFs for Wealth Building?

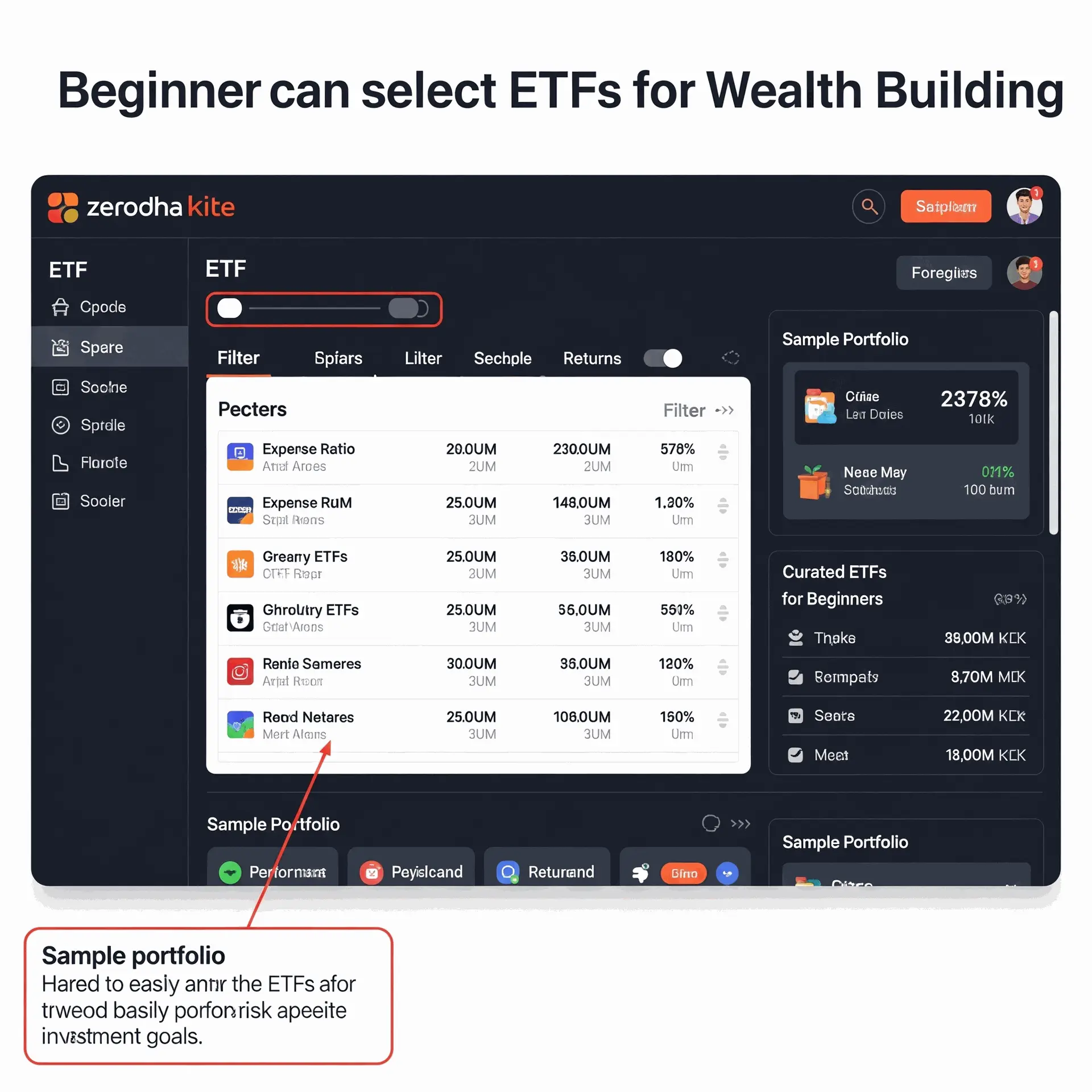

Why should ETFs matter to you? They’re a low-cost, low-stress way to grow wealth over time. In the US, where 401(k)s and IRAs are common, ETFs offer flexibility to diversify without high fees. In India, with rising financial literacy and platforms like Zerodha, ETFs make investing accessible to salaried professionals and young savers. They’re perfect for building wealth steadily—whether for retirement, a home, or your child’s education.

Consider Anjali, a Mumbai freelancer. She invested ₹5,000 monthly in a Nifty Next 50 ETF. In five years, her investment grew 40%, outpacing her savings account. In the US, Mike, a retail worker, put $200 monthly into a Vanguard S&P 500 ETF, seeing similar growth. ETFs spread risk across many assets, making them safer than single stocks. Plus, their low fees mean more of your money grows over time.

5 Key Aspects of ETFs for Wealth Building

ETFs are powerful, but understanding their key features helps you use them wisely. Here are five aspects every beginner should know.

1. Diversification: Spread Your Risk

ETFs hold multiple assets, reducing the impact of one company’s poor performance. A single ETF can track entire markets, like India’s Nifty 50 or the US’s Nasdaq.

- Why It’s Great: Less risk than betting on one stock.

- Example: A Nifty 50 ETF includes giants like Reliance and HDFC Bank, balancing sector ups and downs.

2. Low Costs: Keep More of Your Returns

ETFs have lower expense ratios than mutual funds, often below 0.5%. This means more of your money stays invested.

- Why It’s Great: Low fees compound into big savings over decades.

- Example: A $10,000 investment in a 0.1% fee ETF grows more than in a 1% fee mutual fund over 20 years.

3. Liquidity: Buy and Sell Anytime

ETFs trade like stocks, so you can buy or sell during market hours. This flexibility suits both long-term and active investors.

- Why It’s Great: No lock-in periods, unlike some mutual funds.

- Example: Priya sold her ETF shares to fund a sudden expense, unlike a fixed deposit.

4. Variety: Something for Everyone

ETFs cover stocks, bonds, gold, and even international markets. You can pick based on your goals, like growth (equity ETFs) or stability (bond ETFs).

- Why It’s Great: Tailor your portfolio to your risk appetite.

5. Passive Investing: Set It and Forget It

Most ETFs track indexes, requiring minimal management. This suits busy professionals who want growth without constant monitoring.

- Why It’s Great: Aligns with long-term wealth building.

- Example: Jake’s S&P 500 ETF mirrors the market, growing steadily without daily tweaks.

Which ETF type—stocks, bonds, or gold—suits your goals? Share your thoughts in the comments!

How to Start Investing in ETFs: 5 Actionable Steps

Ready to build wealth with ETFs? Follow these beginner-friendly steps tailored for US and Indian investors.

- Define Your Goals: Are you saving for retirement (US: IRA; India: NPS) or a short-term goal like a car? Clear goals guide your ETF choice.

- Open a Brokerage Account: In the US, try Vanguard or Fidelity; in India, use Zerodha or Groww. Most platforms offer low-cost ETF trading.

- Research ETFs: Look for low-fee, diversified ETFs. US investors might choose VOO (S&P 500); Indian investors can pick Nippon India Nifty 50 ETF.

- Start Small with SIPs/Dollar-Cost Averaging: Invest a fixed amount monthly (e.g., ₹2,000 or $50) to reduce risk and build discipline.

- Monitor and Rebalance Annually: Check your portfolio yearly to ensure it aligns with your goals. Adjust if needed, but avoid over-trading.

Common Mistakes to Avoid with ETFs

ETFs are beginner-friendly, but pitfalls exist. Here’s how to steer clear.

- Chasing Hot ETFs: Buying trendy sector ETFs (e.g., tech-only) can backfire when markets shift. Solution: Stick to broad-market ETFs for stability.

- Ignoring Fees: Even small fee differences add up. Solution: Compare expense ratios before investing.

- Panic Selling: Market dips tempt you to sell. Solution: Focus on long-term growth and avoid checking prices daily.

Final Thoughts

ETFs are your shortcut to wealth building—simple, diversified, and cost-effective. For US and Indian investors, they offer a way to grow money steadily without needing a finance degree. Start small, stay consistent, and let compounding work its magic. Whether you’re aiming for a dream home or a secure retirement, ETFs can get you there.

Take the first step today: research one ETF (like VOO or Nifty 50 ETF) and invest a small amount this month. What’s your big financial goal? Drop it in the comments—I’d love to hear how you’re building wealth!

Blog by Santu Das

Personal Finance Educator | Simplifying Money for Everyday Lives