Beyond Hot Tips: Your Step-by-Step Guide to Mastering Mutual Fund Selection

Ever feel like you're navigating a maze blindfolded when it comes to choosing mutual funds? With thousands of options, each claiming to be the next big thing, it's easy to feel overwhelmed and unsure where to park your hard-earned money. What if you could move beyond hearsay and flashy advertisements, and instead, use a clear, data-driven strategy to pinpoint funds that truly align with your long-term wealth goals? This isn't about finding a fleeting 'hot tip'; it's about mastering mutual fund selection through a systematic process. Get ready to learn a framework that can empower you to invest with clarity and confidence.

What is a Systematic Mutual Fund Selection Strategy?

Simply put, a systematic mutual fund selection strategy is a structured, objective approach to picking funds. It’s about looking beyond just the fund's name or recent star performance. Think of it like a seasoned detective building a case: instead of relying on a single clue or gut feeling, they meticulously gather various pieces of evidence (data points), analyze them, and use a process of elimination to arrive at the most probable suspect (the right mutual fund for you).

This method involves defining specific, measurable criteria – like consistency in returns, risk levels, cost-effectiveness, and fund history – and then rigorously applying these filters to the universe of available funds. It’s about letting the numbers tell a significant part of the story, helping you sidestep emotional biases and the allure of short-term market noise.

Why You Need a Robust Strategy (Not Just Hot Tips!) for Mutual Fund Investing

"My friend recommended this fund," or "I saw an ad for that one"—sound familiar? While well-intentioned, such approaches to investing can be a recipe for disappointment. A robust, systematic strategy for mutual fund selection is crucial, and here's why it directly impacts your financial future:

- Avoiding Costly Mistakes: A systematic approach helps you avoid chasing fads or funds with poor fundamentals hidden beneath a layer of recent good luck. It’s about building a portfolio designed for resilience, not just quick thrills.

- Maximizing Potential Returns (Wisely): While no strategy guarantees future returns, a data-driven approach significantly increases your odds of picking funds managed with skill and a consistent philosophy, which are more likely to deliver sustainable long-term growth.

- Understanding & Managing Risk: Every investment carries risk. A systematic approach forces you to look at risk metrics like maximum drawdown, helping you understand how much a fund might fall during tough times. This means you can choose funds that match your actual risk tolerance, not just your return expectations. Imagine Sarah, a young professional, who poured her savings into a high-flying fund based on a tip, only to see it plummet by 50% during a market correction. Had she analyzed its historical drawdown, she might have opted for a more stable option, aligning better with her moderate risk appetite and avoiding sleepless nights.

- Building Long-Term Wealth with Confidence: When you have a clear 'why' behind each investment decision, you're less likely to panic-sell during market dips or jump ship prematurely. This confidence comes from knowing your choices are backed by solid reasoning and analysis.

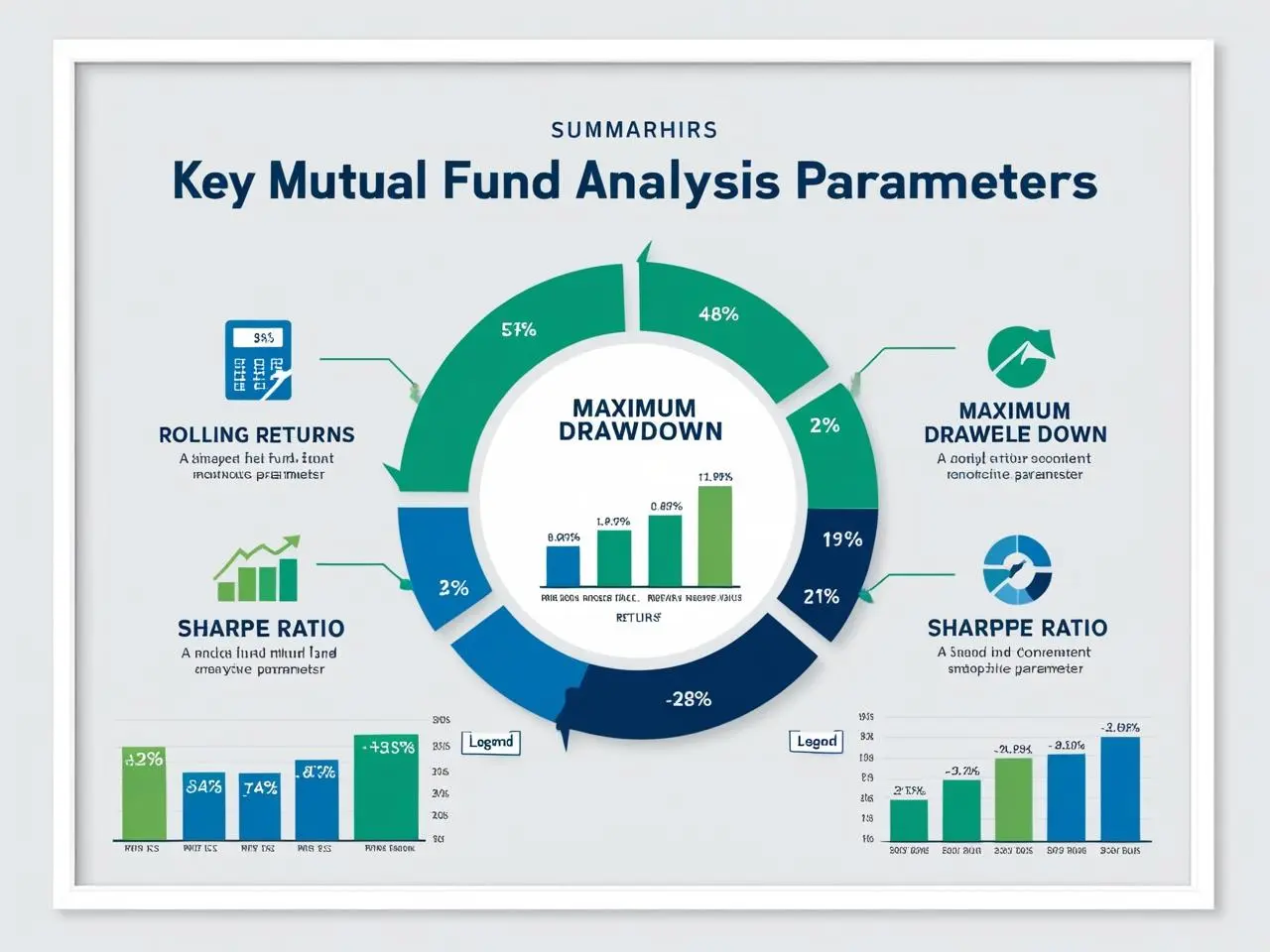

The Core Metrics: Deconstructing Our Data-Driven Fund Selection Framework

To build a winning mutual fund portfolio, we need to look under the hood. Here are the key parameters we use – think of them as the vital signs of a fund's health and potential:

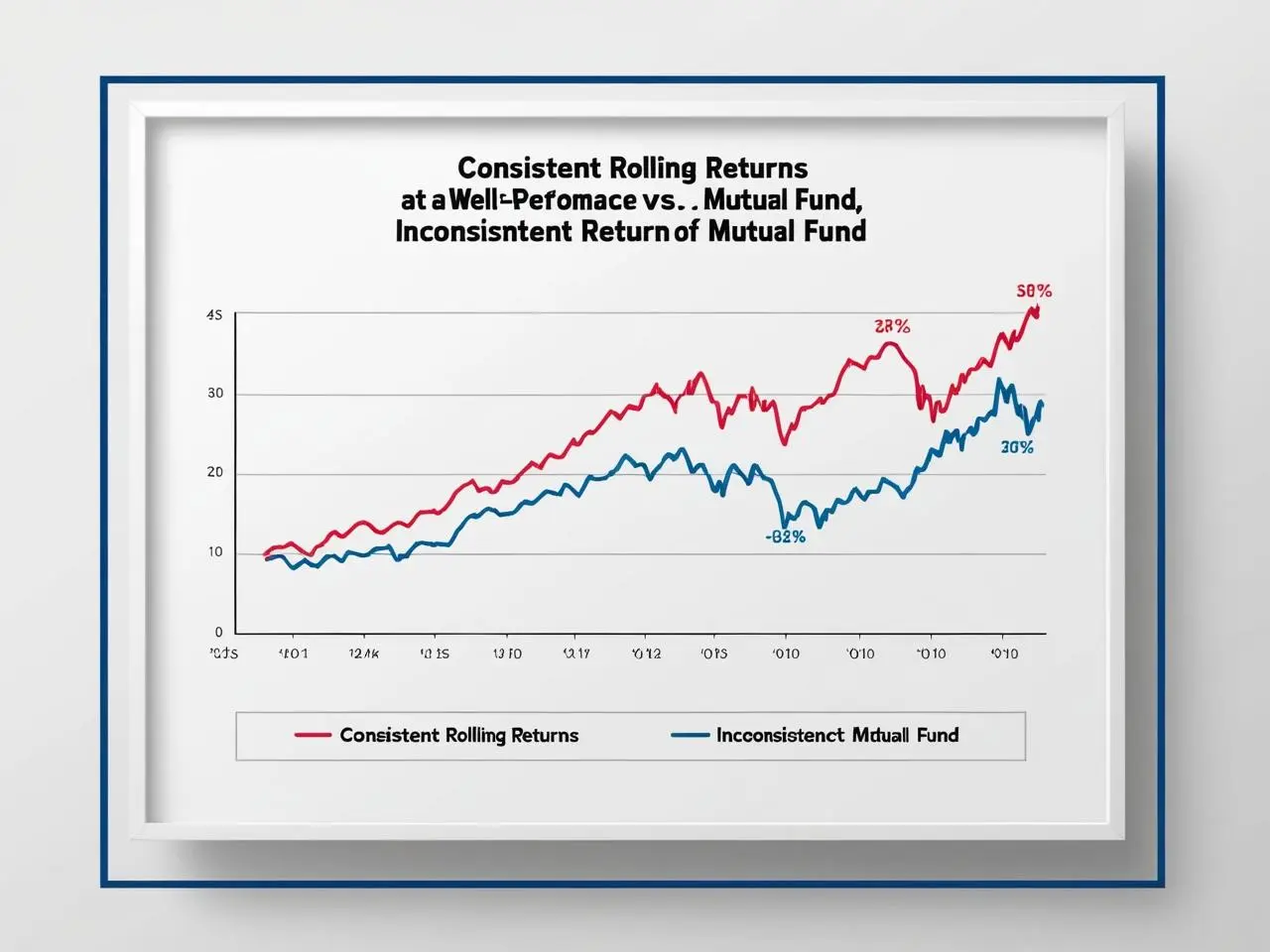

Beyond Simple Returns: The Power of Rolling Returns

You’ve probably seen 1-year, 3-year, or 5-year CAGRs (Compounded Annual Growth Rates). While useful, they can sometimes be skewed by one or two exceptionally good or bad periods. Rolling returns, on the other hand, offer a much deeper insight into a fund's consistency.

Imagine taking a fund's 3-year return, then moving forward one month and taking the 3-year return again, and so on. Averaging these overlapping periods gives you the average 3-year rolling return. A fund with strong rolling returns is like the dependable Rahul Dravid of cricket – consistently scoring well across different matches (market conditions), rather than a Virender Sehwag who might hit a spectacular six sometimes but also get out for a duck more often. We prefer consistency for long-term investing.

How Long in the Game? The Significance of Fund Vintage (3-Year+ Rule)

Would you trust a doctor who just graduated with a complex surgery? Probably not without seeing some experience. Similarly, a mutual fund needs a track record. We typically filter out funds that haven't been in the market for at least three years. This ensures the fund has weathered a few market cycles, and we have enough data to assess its performance and management style. For some comparisons, especially when looking for very long-term consistency, a 5-year or even 10-year history is even better.

Weathering Storms: Understanding Maximum Drawdown

This is a critical risk metric. Maximum Drawdown tells you the most a fund has fallen from its peak to its subsequent trough during a specific period. A lower maximum drawdown suggests better downside protection, which is crucial for investors who are more risk-averse. For instance, if a fund has a maximum drawdown of -20%, it means that in its worst period, an investor could have seen their investment value drop by 20% from its highest point. Knowing this helps you mentally prepare and choose funds that won't give you an ulcer when markets turn volatile.

Smart Risk-Taking: The Role of the Sharpe Ratio

Are you being adequately rewarded for the risk you're taking? That's what the Sharpe Ratio helps determine. It measures a fund's risk-adjusted return by looking at its return over and above a risk-free rate (like a government bond) per unit of total risk (usually measured by standard deviation).

Simply put, a higher Sharpe Ratio (ideally above 1) indicates that the fund has done a better job of generating returns for the amount of risk it has undertaken. It's a very useful tool for comparing funds, especially within the same category.

Are You Getting Value? Our Unique Take on Expense Ratios (Returns vs. TER)

The Total Expense Ratio (TER) is the annual fee fund houses charge to manage your money. Lower is generally better, as every rupee paid in expenses is a rupee less in your potential returns. But we like to take it a step further: we analyze the Rolling Returns divided by the TER. This custom ratio gives us an idea of how much "bang for your buck" you're getting from the fund manager. A higher number here is more favorable, indicating strong returns relative to the cost.

(Mid-post engagement) Which of these metrics do you find most crucial when analyzing a fund, or is there another one you swear by? Share your thoughts in the comments below!

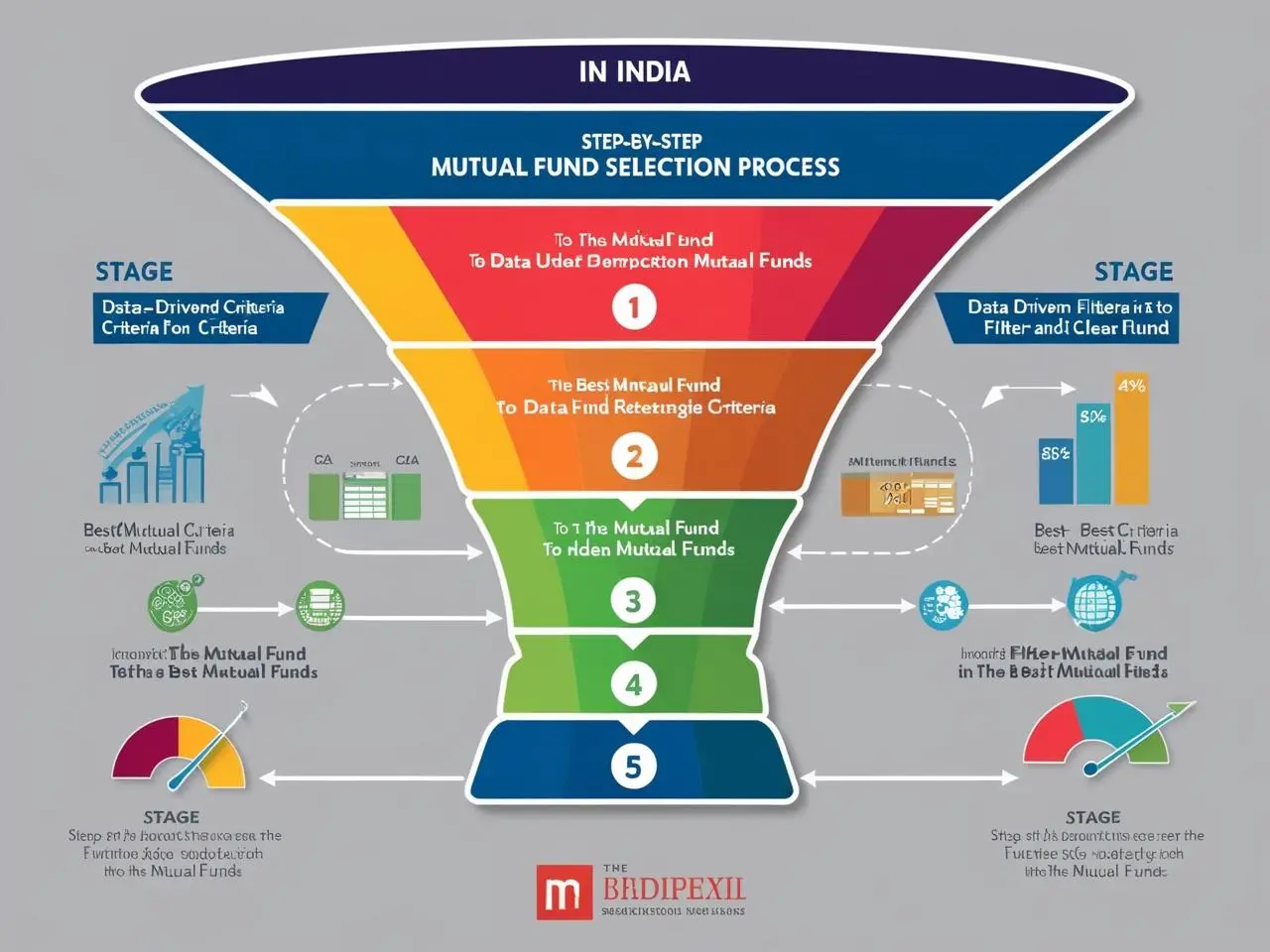

The Elimination Game: Our Step-by-Step Process to Shortlist Winning Funds

Finding the right mutual funds is often a process of intelligent elimination. Here’s a glimpse into the systematic filtering approach, similar to what was demonstrated in the video analysis:

- Define Your Universe: Start by selecting the fund category (e.g., Small Cap, Flexi Cap, Large Cap, etc.) you're interested in based on your risk profile and investment goals.

- Initial Screen – The 3-Year Rule: Filter out any funds that have been in existence for less than three years. We need that historical data.

- Focus on Consistency – Rolling Returns: Sort the remaining funds by their 3-year average rolling returns in descending order (highest to lowest). Often, we might initially narrow down to the top 15-20 performers at this stage.

- Gauge the Risk – Maximum Drawdown: Examine the maximum drawdown figures. If you're risk-averse, you might decide to eliminate funds with excessively high drawdowns, even if their returns are good. Some investors might set a threshold, say, eliminating the top few funds with the highest (worst) drawdowns.

- Check Risk-Adjusted Returns – Sharpe Ratio: Ensure the Sharpe Ratio is attractive, typically above 1. Funds that don't meet this criterion are delivering sub-par returns for the risk taken and can be filtered out.

- The Value Check – Returns vs. TER: Apply our custom ratio of Rolling Returns / TER. Prioritize funds that score well here, as they indicate efficiency in converting management efforts into investor returns.

- Final Shortlist: After these filters, you’ll have a much smaller, manageable list of potential candidates. The video script, for example, aimed to arrive at a "Top 5" list for each category using such refinements.

This iterative filtering helps narrow down a large pool of hundreds of funds to a handful of quality contenders, making your mutual fund selection process far more robust and data-backed. Remember, financial tools and screeners (like Tickertape, as used in the script, or others) can be immensely helpful in applying these filters practically.

Applying the Framework: Identifying Potential Strong Performers Across Fund Categories

The beauty of this systematic framework is its adaptability across various mutual fund categories. While the core principles remain the same, the emphasis on certain parameters might shift slightly based on the category's inherent nature. Here’s how this methodology can help when looking at different types of funds, drawing insights from the kind of analysis presented in the script:

Small-Cap Funds: Balancing Growth with Resilience

- Focus: High growth potential, but also higher volatility. The key here is identifying funds with consistently strong rolling returns that can navigate the turbulence. Drawdown becomes a critical factor to watch.

- Outcome of systematic filtering: Funds that emerged strong often showcased excellent 3-year and 5-year CAGRs, superior rolling returns, and manageable drawdowns despite the segment's nature. Good Sharpe ratios were a must.

Flexi-Cap Funds: The All-Weather Strategy

- Focus: Flexibility to invest across market capitalizations. Here, consistent rolling returns and a good Sharpe ratio are paramount, indicating skillful fund management in varying market conditions. The ability to protect downside (drawdown) is also key.

- Outcome of systematic filtering: Top contenders often demonstrated impressive 3-year average rolling returns, good drawdown control, and robust Sharpe ratios, suggesting they effectively utilized their flexible mandate.

Mid-Cap Funds: Hunting for Future Blue Chips

- Focus: Identifying companies with significant growth potential. Strong rolling returns over 3 years are a good indicator, coupled with a Sharpe ratio above 1. Expense ratios are also watched, as superior performance needs to justify the costs.

- Outcome of systematic filtering: Funds making the cut typically showed high 3-year rolling returns, evidence of good risk-adjusted returns (Sharpe ratio), and a track record of weathering market downturns reasonably well.

Large-Cap Funds: Stability and Consistent Compounders

- Focus: Relatively lower risk and stable, albeit potentially more moderate, returns from established companies. Here, long-term rolling returns (5-10 years if available) and low drawdowns become even more important, alongside competitive Sharpe Ratios and reasonable expense ratios.

- Outcome of systematic filtering: The shortlisted funds usually had long track records, commendable 3-year rolling returns (often above category averages), good Sharpe ratios, and a history of providing downside protection.

Large & Mid-Cap Funds: The Best of Both Worlds?

- Focus: A blend of stability from large caps and growth from mid-caps. Consistent 3-year rolling returns, a Sharpe ratio above 1, and manageable drawdowns are key, alongside the fund’s ability to navigate both market segments.

- Outcome of systematic filtering: The funds that stood out typically demonstrated a strong balance, reflected in their rolling returns and risk metrics across cycles that included both large and mid-cap outperformance.

Multi-Cap Funds: Diversification by Mandate

- Focus: Mandated minimum allocation to large, mid, and small-cap stocks. Consistency in rolling returns, an effective Sharpe ratio, and controlled drawdown are crucial, given the diversified exposure. The custom Return/TER ratio also helps identify value.

- Outcome of systematic filtering: Top-performing multi-cap funds usually showed robust rolling returns, attractive Sharpe Ratios, and drawdowns that reflected prudent management across market caps.

Hybrid Funds: Tailoring Your Equity-Debt Mix (Aggressive & Conservative)

- Focus: A mix of equity and debt, with 'Aggressive' funds having higher equity exposure and 'Conservative' ones more debt. For Aggressive Hybrids, look for equity-like rolling returns and Sharpe ratios, with drawdowns better than pure equity. For Conservative Hybrids, capital preservation (very low drawdown) and steady, inflation-beating returns are key. Expense ratios are particularly important in lower-return categories.

- Outcome of systematic filtering:

- Aggressive Hybrid: Shortlisted funds provided good rolling returns for their equity portion and reasonable drawdowns.

- Conservative Hybrid: The focus led to funds with very low drawdowns and consistent, albeit modest, returns, with competitive expense ratios.

Disclaimer: The specific funds that may appear "top" based on this filtering methodology can change over time as data updates. This guide focuses on teaching you the process of selection, not on recommending specific funds. Always do your own research or consult a financial advisor.

Common Mistakes to Avoid in Your Mutual Fund Journey

Even with a solid framework, it’s easy to stumble. Here are a few common pitfalls to sidestep:

- Blindly Chasing Past Performance: Today's chart-topper isn't guaranteed to be tomorrow's. While historical performance is a factor, it shouldn't be the only factor. Focus on consistency (rolling returns) rather than a recent stellar year.

- Ignoring Risk Metrics Completely: Many investors focus solely on returns and forget to check how bumpy the ride might be (volatility, drawdown). We've all been tempted by high return numbers, but understanding the associated risk is paramount for staying invested.

- Over-Diversification (Diworsification): Owning too many funds, especially if they have overlapping holdings or strategies, doesn't necessarily reduce risk further and can dilute returns. It also makes your portfolio incredibly hard to track.

- Mismatching Funds with Financial Goals or Time Horizon: Investing in a small-cap fund for a short-term goal (say, less than 3 years) is generally a recipe for anxiety. Ensure your fund choices align with when you need the money and the risk you can afford for that goal.

- Frequent Switching Based on Noise: Constantly churning your portfolio based on market news or temporary underperformance can be detrimental due to exit loads, taxes, and missing out on long-term compounding. Stick to your strategy unless fundamentals truly change.

Final Thoughts

Choosing the right mutual funds doesn't have to feel like a lottery. By adopting a systematic, data-driven mutual fund selection strategy—focusing on consistent rolling returns, appropriate risk management through drawdown analysis, rewarding risk-adjusted returns via the Sharpe ratio, and demanding value for your expense ratio—you transform from a passive spectator into an empowered investor.

This framework provides a robust starting point. Remember, the goal isn't just to pick funds, but to build a portfolio that works diligently towards your financial aspirations.

What's one insight from this guide that you'll implement in your mutual fund selection process starting today? Or, what's the biggest challenge you face when choosing funds? Share your thoughts and questions in the comments below – let’s learn together!

AMFI (Association of Mutual Funds in India): Association of Mutual Funds in India (For investor education resources and data)

Securities and Exchange Board of India (For regulatory information and investor awareness)

Disclaimer

The content on this blog is for informational and educational purposes only and should not be considered financial or investment advice. I am not a SEBI registered investment advisor. Please consult with a qualified financial advisor before making any investment decisions. The author/blog assumes no liability for any financial losses incurred. All investments are subject to market risks.

Blog by Santu Das

Personal Finance Educator | Simplifying Money for Everyday Lives