5 Best ETFs for Long-Term Investment: Build Wealth Without the Stress

Have you ever felt overwhelmed by the idea of investing in the stock market? Maybe you’ve heard about ETFs but aren’t sure where to start or which ones could help you build wealth over decades without constant monitoring. You’re not alone—many Indians, especially young professionals, want a simple, effective way to grow their money while focusing on their careers and lives. That’s where Exchange-Traded Funds (ETFs) come in. In this guide, you’ll discover five powerful ETFs you can hold for life, why even small returns matter over time, and how to avoid common pitfalls. Ready to take control of your financial future with confidence? Let’s dive in!

What is an ETF?

An Exchange-Traded Fund (ETF) is like a basket of stocks or other assets that you can buy and sell on the stock exchange, just like individual stocks. Think of it as a ready-made pizza: you don’t need to pick every topping (or company) yourself; the ETF bundles top-quality ingredients (stocks) for you. Unlike mutual funds, which are priced once a day, ETFs allow you to trade throughout the day, giving you flexibility to seize market opportunities—like buying during a dip, such as the market crash on June 4, 2024, after election results.

ETFs track indices like the Nifty 50 or Nifty Midcap 150, offering diversification with lower costs. For example, I recall helping a friend, Priya, who was new to investing. She was hesitant, thinking she needed to research individual stocks. When I explained ETFs as a low-effort way to invest in India’s top companies, she felt empowered to start her journey. That’s the beauty of ETFs—they simplify wealth-building.

Why Should You Care About ETFs for Long-Term Investment?

ETFs are a game-changer for busy professionals who want their money to work without micromanaging. They offer low costs, diversification, and the potential for steady growth. Why does this matter? Consider Anil, a 30-year-old IT professional earning ₹50,000 monthly. By investing ₹10,000 monthly in ETFs with a 12% annual return and stepping up his investment by 10% each year, he could amass ₹7.87 crore in 25 years. If he earns just 0.5% more—12.5%—that grows to ₹8.36 crore. That extra ₹49 lakh is life-changing, all from a small difference in returns!

ETFs also reduce risk by spreading your money across multiple companies, so one stock’s poor performance doesn’t derail your portfolio. For Indian investors, ETFs tracking indices like the Nifty 50 or Nifty 500 offer exposure to India’s growth story, making them ideal for long-term wealth creation.

5 Key ETFs to Hold for Life

Here are five ETFs you can confidently hold for decades, each chosen for its low costs, high trading volume, and exposure to India’s top companies. These selections are based on expense ratios, historical performance, and market representation.

Nifty 50 ETF

- What It Is: Tracks India’s top 50 companies by market capitalization, like Reliance and HDFC Bank.

- Why Choose It: Offers stability and exposure to blue-chip companies. For instance, Nippon India ETF Nifty 50 has an expense ratio of just 0.04%, meaning you pay only ₹4 annually for every ₹10,000 invested—almost negligible!

- Key Insight: High trading volume (e.g., 1.13 crore units daily for Nippon’s ETF) ensures liquidity, so you can buy or sell easily.

Nifty Next 50 ETF

- What It Is: Tracks the next 50 companies (ranked 51–100 by market cap), often called “junior large-caps.”

- Why Choose It: These companies, like Adani Enterprises, have high growth potential. ICICI Prudential Nifty Next 50 ETF boasts a 3-year return of 68% and an expense ratio of 0.1%, outperforming Nippon’s 54% return.

- Key Insight: Compare expense ratios and trading volumes when choosing (ICICI’s volume is 5.1 lakh units daily).

Nifty Midcap 150 ETF

- What It Is: Invests in the top 150 mid-sized companies, offering a balance of growth and risk.

- Why Choose It: Midcaps often outperform large-caps over time. Mirae Asset’s Nifty Midcap 150 ETF has a low 0.06% expense ratio and an 11% 1-year return, compared to Nippon’s 8%.

Nifty Smallcap 250 ETF

- What It Is: Tracks 250 smaller companies with high growth potential but higher risk.

- Why Choose It: HDFC Nifty Smallcap 250 ETF has a 0.2% expense ratio and strong daily volume (9,75,000 units), ensuring liquidity.

- Key Insight: Smallcaps can boost returns but require a long-term horizon to weather volatility.

Nifty 500 Momentum 50 ETF

- What It Is: A smart beta ETF selecting 50 high-momentum stocks from the Nifty 500 based on normalized momentum scores.

- Why Choose It: Motilal Oswal’s Nifty 500 Momentum 50 ETF has delivered 22% returns since inception, far outpacing Nifty’s 13–14%. Its 0.41% expense ratio is higher but justified by its performance.

- Key Insight: Momentum investing targets stocks with upward price trends, ideal for long-term outperformance.

How to Choose and Invest in These ETFs

Ready to build your lifelong ETF portfolio? Follow these actionable steps:

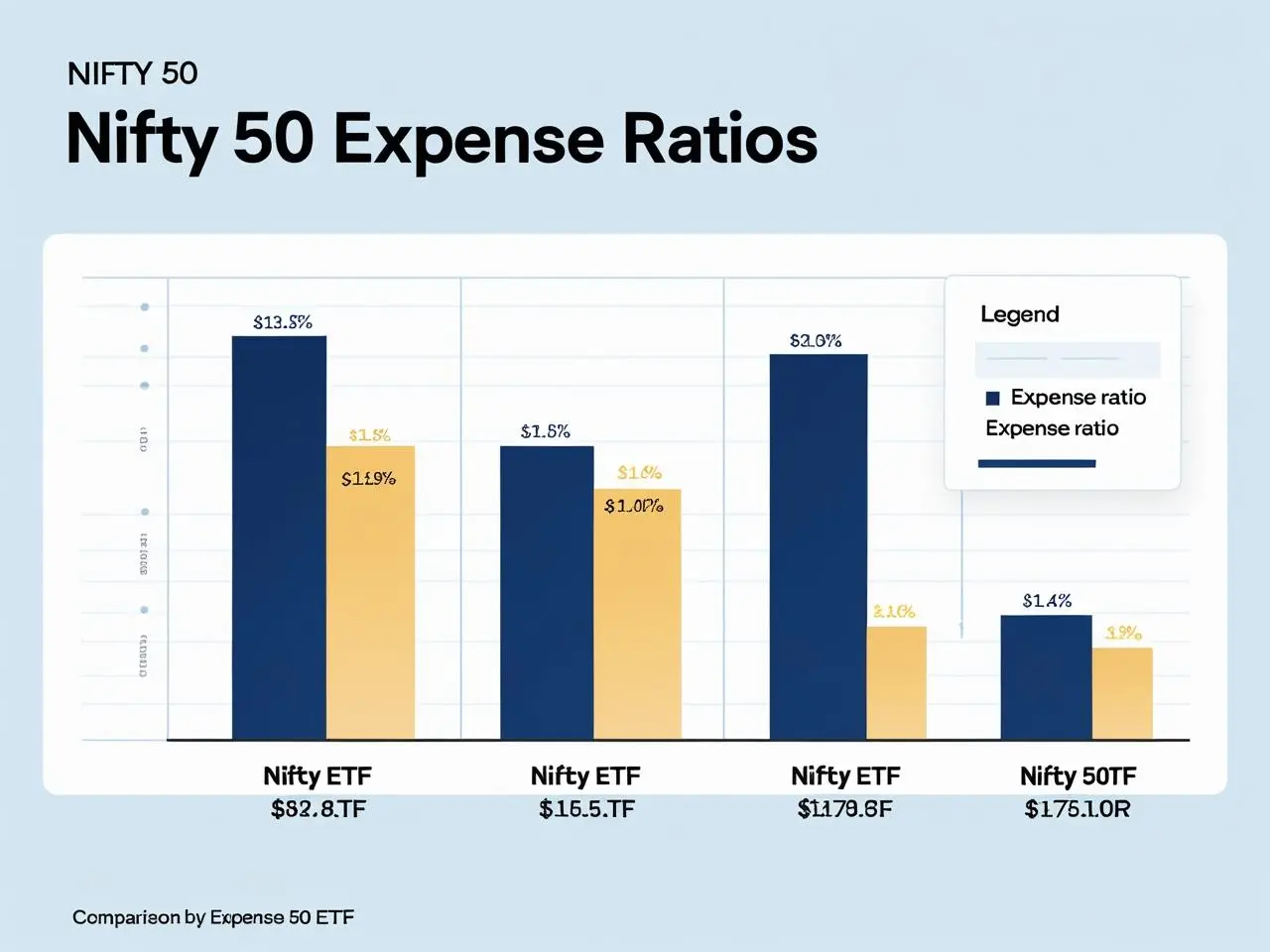

- Research Expense Ratios: Compare ETFs within the same category (e.g., ICICI vs. Nippon Nifty 50). Lower expense ratios (like 0.03–0.06%) save you money over decades.

- Check Trading Volume: Ensure high liquidity (e.g., 1 lakh+ units daily) to avoid issues when buying or selling.

- Set Up a SIP: Treat ETFs like mutual fund SIPs. Invest a fixed amount monthly (e.g., ₹5,000) to benefit from rupee-cost averaging.

- Diversify Across ETFs: Allocate funds across Nifty 50, Next 50, Midcap 150, Smallcap 250, and Momentum 50 for broad market exposure.

- Monitor Periodically: While these ETFs are “set-and-forget,” review annually to ensure they align with your goals.

Which of these steps feels most doable for you right now? Share your thoughts in the comments!

Common Mistakes to Avoid When Investing in ETFs

ETFs are simple, but pitfalls exist. Here’s what to watch out for:

- Chasing High Returns Without Understanding Risks: High-return ETFs like Nifty 500 Momentum 50 have higher expense ratios and volatility. Balance your portfolio with stable Nifty 50 ETFs to mitigate risk.

- Ignoring Expense Ratios: A 0.17% mutual fund expense ratio vs. a 0.04% ETF ratio can cost you ₹1 lakh over 25 years, as shown earlier. Always compare costs before investing.

- Not Diversifying: Investing only in one ETF (e.g., Nifty 50) limits growth potential. Spread investments across large-, mid-, and small-cap ETFs for optimal returns.

Final Thoughts

Investing in ETFs is like planting a tree today that provides shade for decades. By choosing low-cost, high-volume ETFs like the Nifty 50, Nifty Next 50, Nifty Midcap 150, Nifty Smallcap 250, and Nifty 500 Momentum 50, you’re setting yourself up for long-term wealth without the stress of active trading. The key? Start small, stay consistent, and let compounding work its magic. What’s one ETF you’re excited to explore or one step you’ll take today? Share in the comments, and let’s build your financial future together!